Widgetized Section

Go to Admin » Appearance » Widgets » and move Gabfire Widget: Social into that MastheadOverlay zone

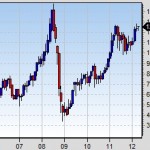

Commodities regaining some lost ground

Commodities have seen some lackluster påerformance for the last couple of months. But fear no more. The vigorous commodity bulls seems to have regained some lost cojones. Don´t take our word for it, just take a look at these longer-term charts to give you the bigger picture.

The Gold Spot price remains safely tucked away in its longer-term upwards trend. Lately we have seen it gain some momentum to the upside and one has to wonder whether the perennial bull Jim Rogers will once again prove to be right regarding the soundness of commodities and the shortcomings of paper money. You have to give it to the Europeans though; they didn´t cave in until the last minute and there still seems to be some central bankers around (predominantly german ones) who feel that they should actually be independent and that their primary job is to ensure price stability (go figure). Although LTRO1 and 2 will give the European politicans some breathing room the underlying conditions remain unchanged. Cheap money does not accomplish much in the long run. But in the short run it has provided the commodities market with somewhat of a revival. Let´s have a look at Brent Oil, which is now once again reaching for the 2008 highs:

While all commodities do not show the same type of renewed buying interest, at least the “hit-that-bid”-followers have taken a break in most instances. Just imagine what an impressive pile of digitally produced cash can accomplish…